Currently, the overall sentiment among the investment public seems to be of a very cautious nature. With the recent roller coaster ride we have been on, this is very normal. Nobody likes uncertainty and uncertainty is magnified when a substantial amount of your net worth seems to be bouncing around.

This happened again with the slide down we went through in May. This was all after we rode the relatively big dip down from October 1st to Christmas Eve 2018; followed by a quick (although welcome) rubber band snapback to the upside in January and February AND a steady climb up through the end of April. Tiring? For some people, yes.

If you didn’t notice any of these ups and downs I say, “Well done!”. You aren’t looking at your statements and thus subjecting yourself to the short term “Mr Market” manic depressive reactions to data and news noise, affect your rationality and long term focus. As Warren Buffett has said, “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for 5 years.” In this same vein, I heard a recent stat from one investment management firm that said, the people that forgot they had investment accounts with them (or they had died) made more money than those that kept looking at their portfolio and selling just because something went down in price (they also sleep better).

This isn’t to say you simply leave your portfolio alone. You need to always ensure you have investments that are not overpriced. This is an ongoing process. If they are, you want to have them sold to other people who are not very discerning (or frankly, reckless). Risk is taken out of a portfolio by only holding investments that are at a price below what the investment is actually worth.

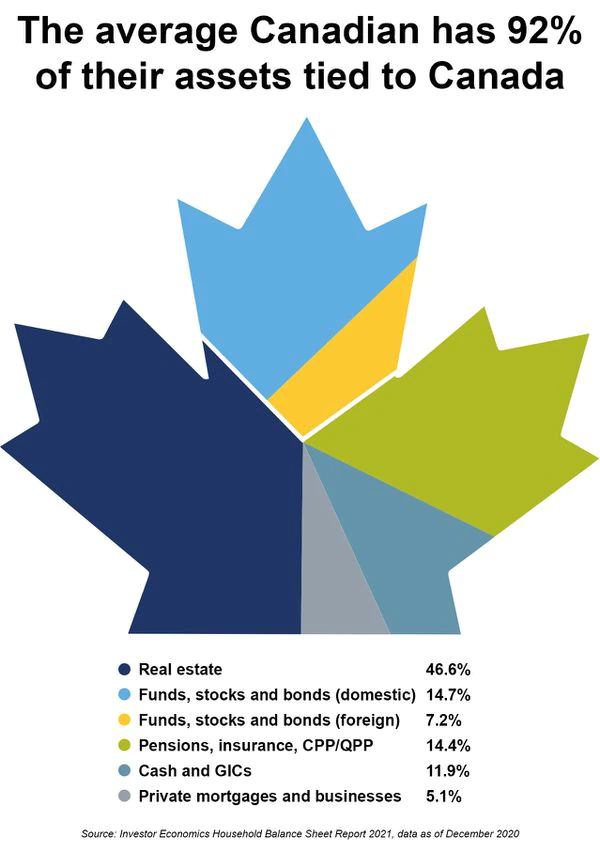

The reality though is, many people have an investment portfolio that isn’t continually having the risk taken out and the opportunity increased. This is often because the portfolio has constraints on it. Most often it is because there is an investment product within the portfolio than can only invest in a particular area or country (ie Canada or the USA). Also, it may only be allowed to invest in equities. There is no ability (or investment talent) to uncover and exploit price discrepancies in an investment area outside of the relatively narrow mandate.

As well, many portfolios must be fully invested in a particular asset (ie 100% equities, 100% bonds etc). They can’t sell an investment and let the cash proceeds sit in the portfolio. They aren’t allowed to wait until they find something that is of compelling value. They have to invest in something, despite that something being not the best thing to do at that time.

These kind of portfolios can subject you to significant risk. Your portfolio may hold or be buying investments that are too expensive. You could be on the sharp edge of permanent loss of capital or, you might have to wait many years to make up the loss.

Active investment management, one that has a broad mandate, can hold cash if there is nothing that currently appears to be a worthwhile investment, at current prices. Active management, with a broad investment mandate, actually thrives during these rollercoaster dips. However, the active management has to have the ability to buy whatever it finds to be particularly attractive.

One broad example of that is having the ability to, instead of investing in the equity of a company, buy their bonds. When you have an investment management firm / team that can fully analyze the complete financial health and capital structure of a company, they can determine what represents better value. Investing in the equity of a particular company can be quite risky yet the bonds represent a relatively safe place to invest. Broader speaking, during a market downturn, generally the bonds of a company decline in value much less than equity prices do. This is why, it is important to ensure your portfolio can invest almost anywhere (and not be the one responsible for pulling the trigger, allowing you to live your live to the fullest).

PS. Here is a recent talk (under 4 minutes) on difference of investing in high yield bonds vs equities, in relation to market ups and downs.