I’ve seen it over and over, my entire Financial Advising career; there are always people trying to guess when the best time to invest is or when to cash out before a major market decline. I get that sense from everyday news and written articles and I on occasion, get that from a client. The fact is, nobody can consistently determine the best time to invest. Yes, you might make a lucky call (or maybe 2) on predicting what will happen (I know I have) however, you would have to be able to predict events consistently if you want to beat those who simply invest money as they accumulate it.

At this very moment, I’m sure there are many people reading this who are sitting on thousands, tens of thousands or even hundreds of thousands of dollars in cash. Yet, today they don’t want to commit to investing for the simple reason that today might not be the best time.

When will it be? Among the many green shoots that we are seeing today around the world, the very small signs of light that we are moving forward, what 1 thing of the thousands of variables or signs are you waiting to change? What does that one thing you see as so important, that will be the ultimate catalyst to give you a green light? If it is an obvious one, like a Covid-19 vaccine, don’t you think many others will see it at the same time thus, making the art of guessing, totally useless? That good news will very quickly be reflected into the investments you were waiting to buy.

I remember years ago Sir John Templeton, one of the most successful investors of the 20th century always said “the best time to invest is when you have the money”. He was a strong believer in allocating money to a portfolio management team with a good track record and letting them make the individual investment decisions. Their overall objective, one they do day in and day out, year in year out is trying to buy individual companies at discounted prices. I agree with him completely.

Despite that, our flawed human nature often has us 2nd guessing wisdom. We choose inertia which can prove to be an inferior choice. Yes, it is a choice as the song Freewill by the band Rush states, “If you choose not to decide you still have made a choice”. You may even try justifying it because you have heard “Buy Low & Sell High”, right? Yes, but read that more closely. Does it say “Buy At the Lowest Point And Sell At the Highest Point? No, because you only know when that is after the fact.

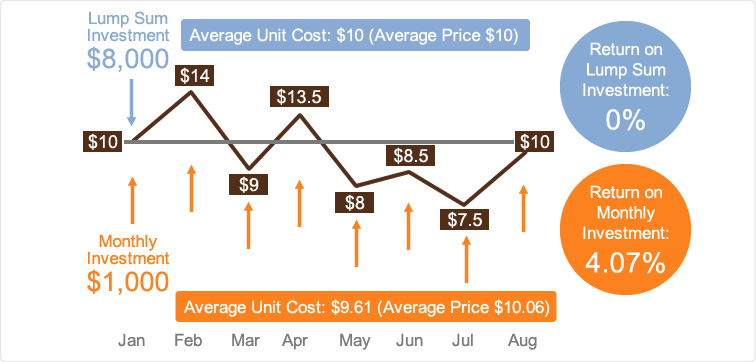

So how do you choose a long-term course of investing that has proven itself successful over many generations of investment history? In uncertain times and in times when it is hard to decide what to do, it is always best to look back objectively and see what has worked in the past. Today is no different and the best decision to get you out of your inertia is to go with “dollar cost averaging” or DCA.

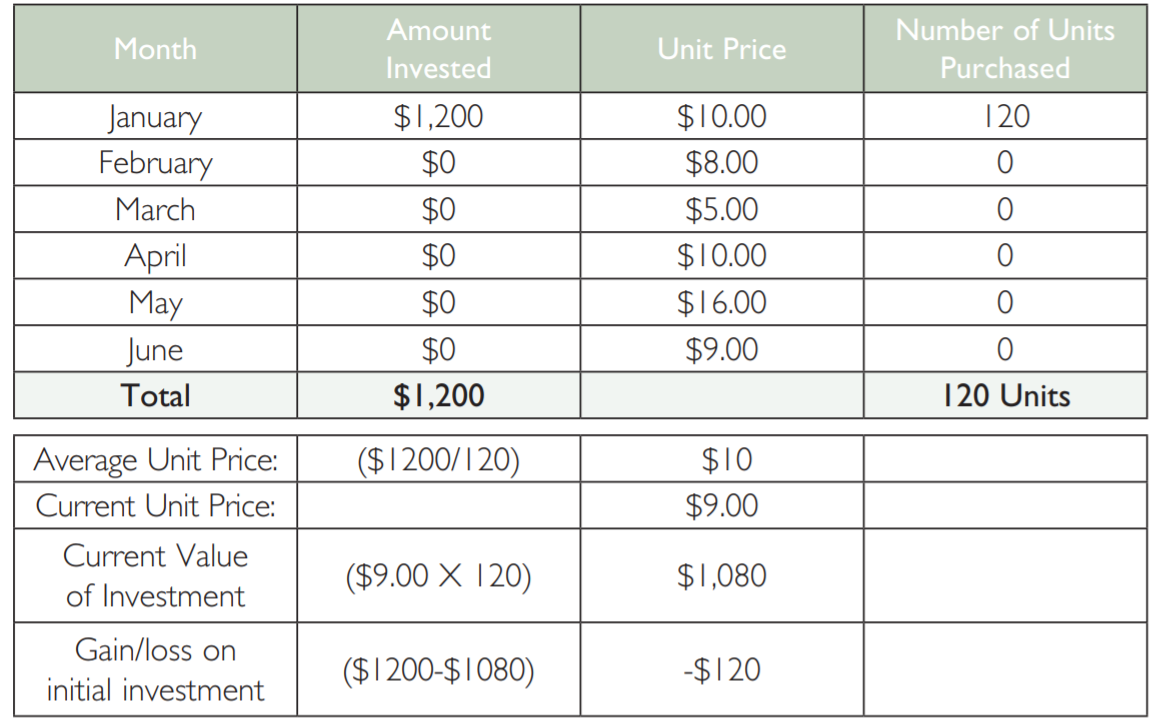

DCA isn’t anything, new, exciting, cutting edge or chic. It is a simple habit of investing a fixed amount of money, consistently and generally, every week, 2 weeks, twice a month or once a month. Below are 2 examples of 2 different approaches. The first is, investing a lump sum. In this case it is done before an investments price fluctuates widely, even falling by 50% of the initial investment at one point:

As you can see, the $1,200 invested is down over this period of time. However, quality investments over the long term will increase in price. What you see here is just the short term result and not necessarily a terrible place to be since 10% is a modest decline, particularly since this investment was down by 50% at one point.

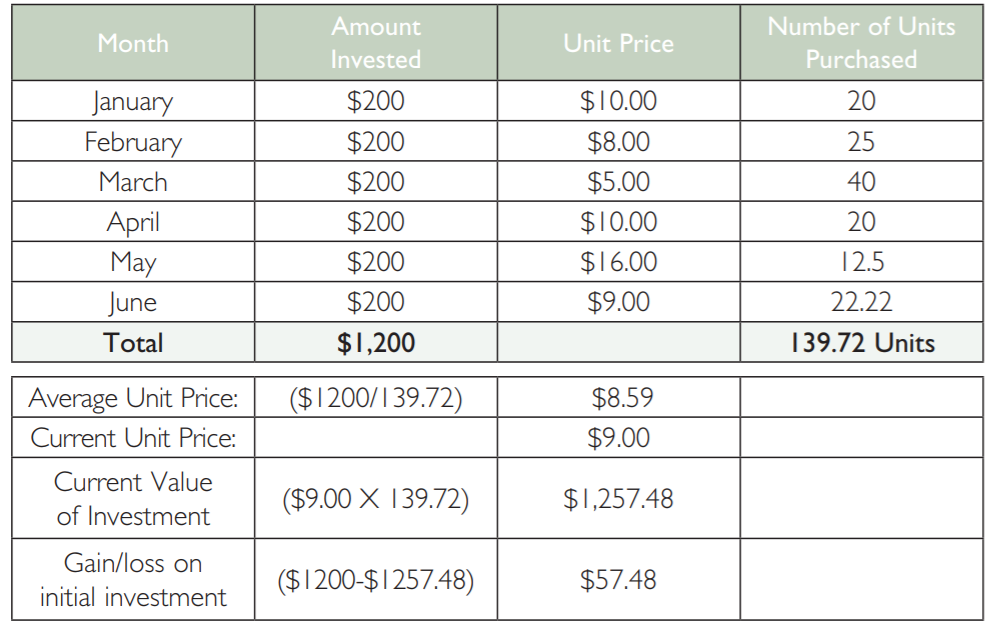

Now let’s look at the same investment experience but using DCA:

Both scenarios have the same investment yet using DCA, despite the invest price being down by 10%, the DCA way of investing has produced a gain.

If you run this scenario with a less severe swing in both directions, the end benefit is smaller with DCA. In fact, with DCA the more the price of the investment fluctuates, the better your long term result. In the end though, wasn’t the reason for holding onto your cash a way to not make a mistake by investing just before a large drop in the investment’s price? DCA takes care of that and you will more likely than not, end up with a better result.

Going back to Sir John Templeton’s mantra of investing when you have the money. Most of the time we are earning money on a relatively consistent basis, week in, week out. You pay your daily, week and monthly expenses and every month you should have a bit of surplus of cash that is to save for a time when you can’t (or don’t want to) go out and earn your income. “Paying yourself” monthly fits perfectly with DCA. You receive money monthly so the follow through is to invest money monthly. You are never having money accumulate in a bank account thus moving you to the never ending, 2nd second guessing loop.

This basic principle can successfully be applied when you have a lump sum of cash that is caught in your inertia. Whether it be $20,000, $200,000 or $2 million, you simply determine a weekly, bi-weekly or monthly amount you want automatically allocated to an investment or portfolio. $100,000? Take $2,000 every week and have it set up to be systematically invested over the next 50 weeks. The world will look a whole lot clearer in 50 weeks and if you don’t put this money to work using DCA I’m quite sure you will still be sitting on your cash a year from now.

The basic point is that we are often our own worst enemy when trying to make investment decisions. This can be whether we are trying to time things or simply getting caught up with consumerism and spending virtually every dollar we make (or most of it). Invest using logic, based on historic evidence and focus on the end of the time frame you plan on investing for. Stick to it, get out of the way and let what has proven to work, do its job.