Investment prices have come down over the past few months. It might seem ironic for an advisor to write something after investment markets have come down, particularly to support people who have cash to invest. Let me further explain this however.

Investments are the only area in life where we tend to think and act rather irrationally when it comes to prices. When food, a car, clothing, travel, etc. are cheaper today than they were a week, a month or a year ago, we feel compelled to go out and buy those goods and services. We don’t wait longer, to see if the price will go down more, we simply buy at this great “sale” price. Not usually so with investments. While we try to convince ourselves otherwise, emotions are the over-riding factor in this inaction. This is why I thought it’s a good time to include a selection of graphs (followed by a brief explanation of the graph) from the reams of data I could put in front of you to help you understand where we are at today. Here goes:

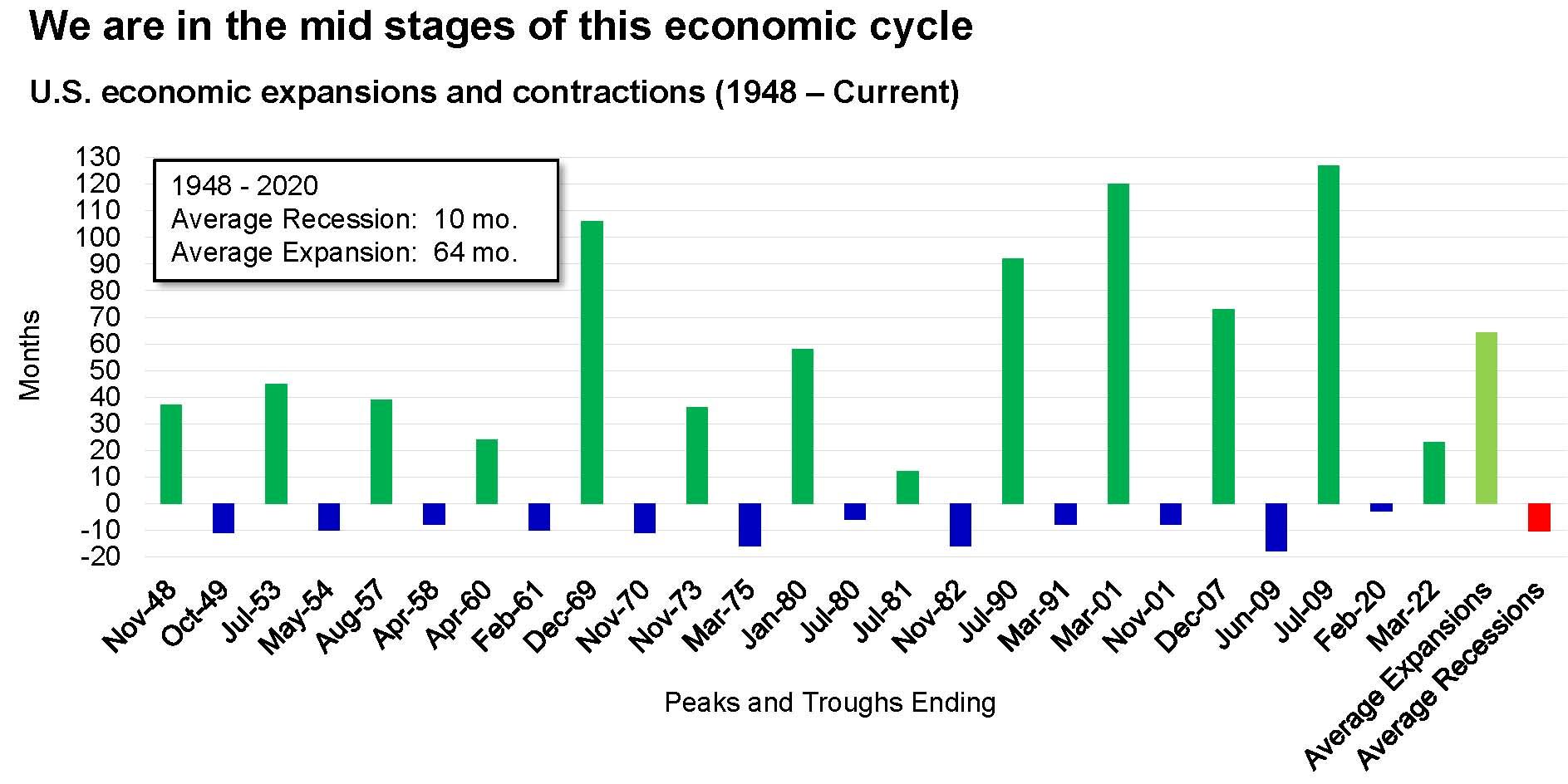

Economic expansions last on average 64 months. Since the last significant drop, which was triggered by the screeching economic halt Covid brought us, we are about 1/3rd of the way through a typical economic expansion cycle. What we are probably witnessing now is a pause or transition into what could be the longest part of the economic expansion. In baseball terms, we are in the 3rd inning. Hockey? We’ve finished the 1st period. You don’t want to be in the washroom when the game resumes.

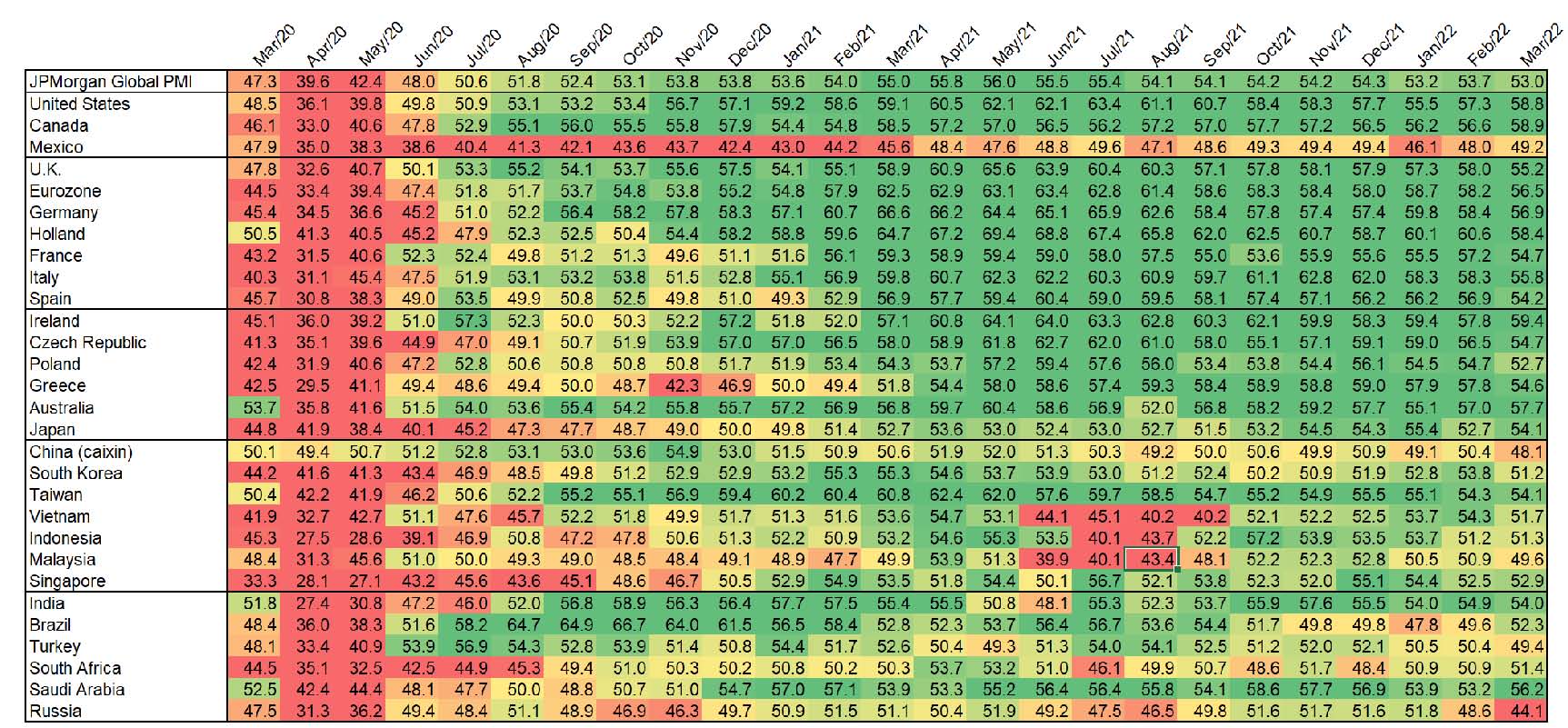

This is a “heat chart”. Green means positive. It shows that global economic activity has moved to a very strong place since the start of Covid.

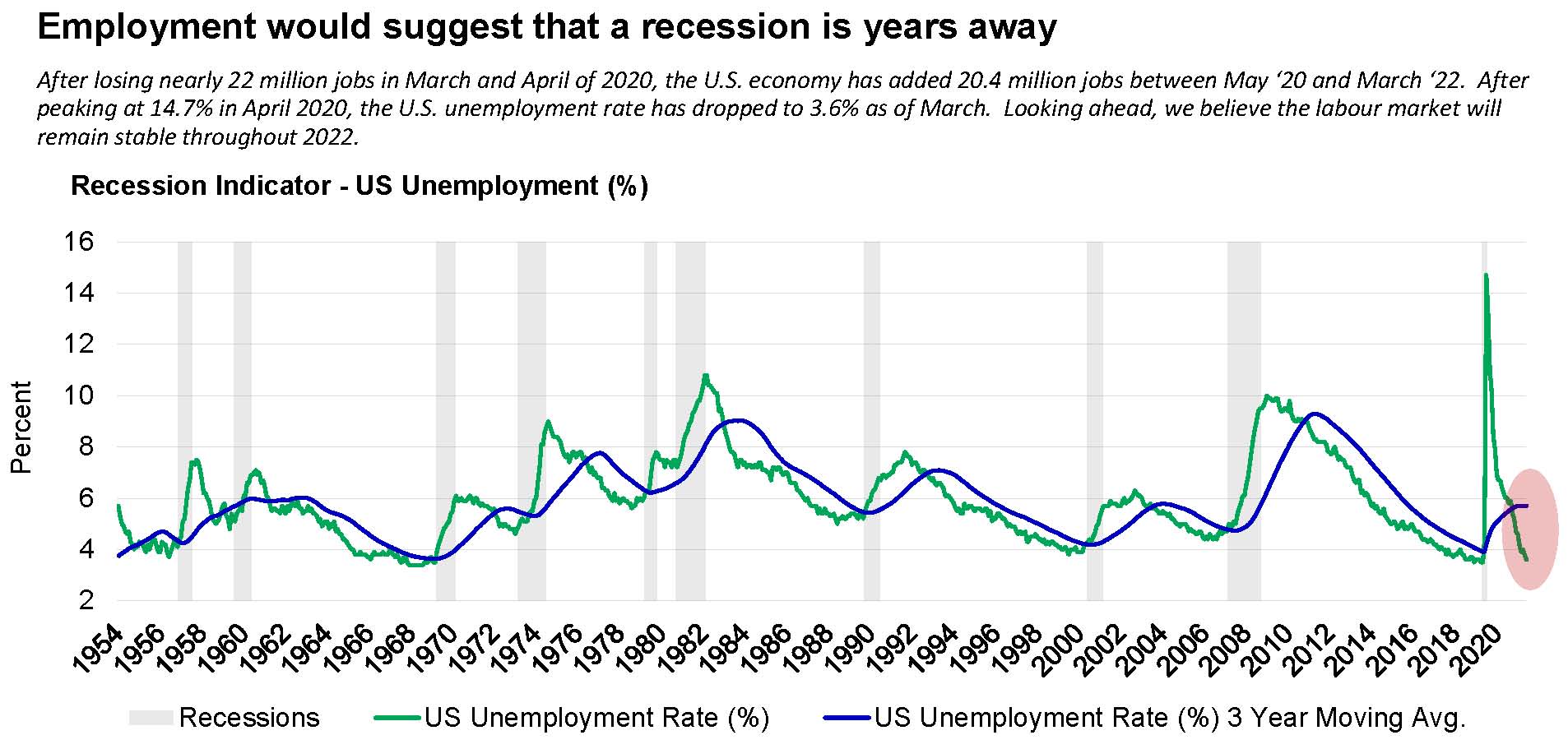

Employment is the strongest it has been in years. If we were moving into a recession, we would have to see a whole lot of layoffs. Probably not going to happen with the strong labour market.

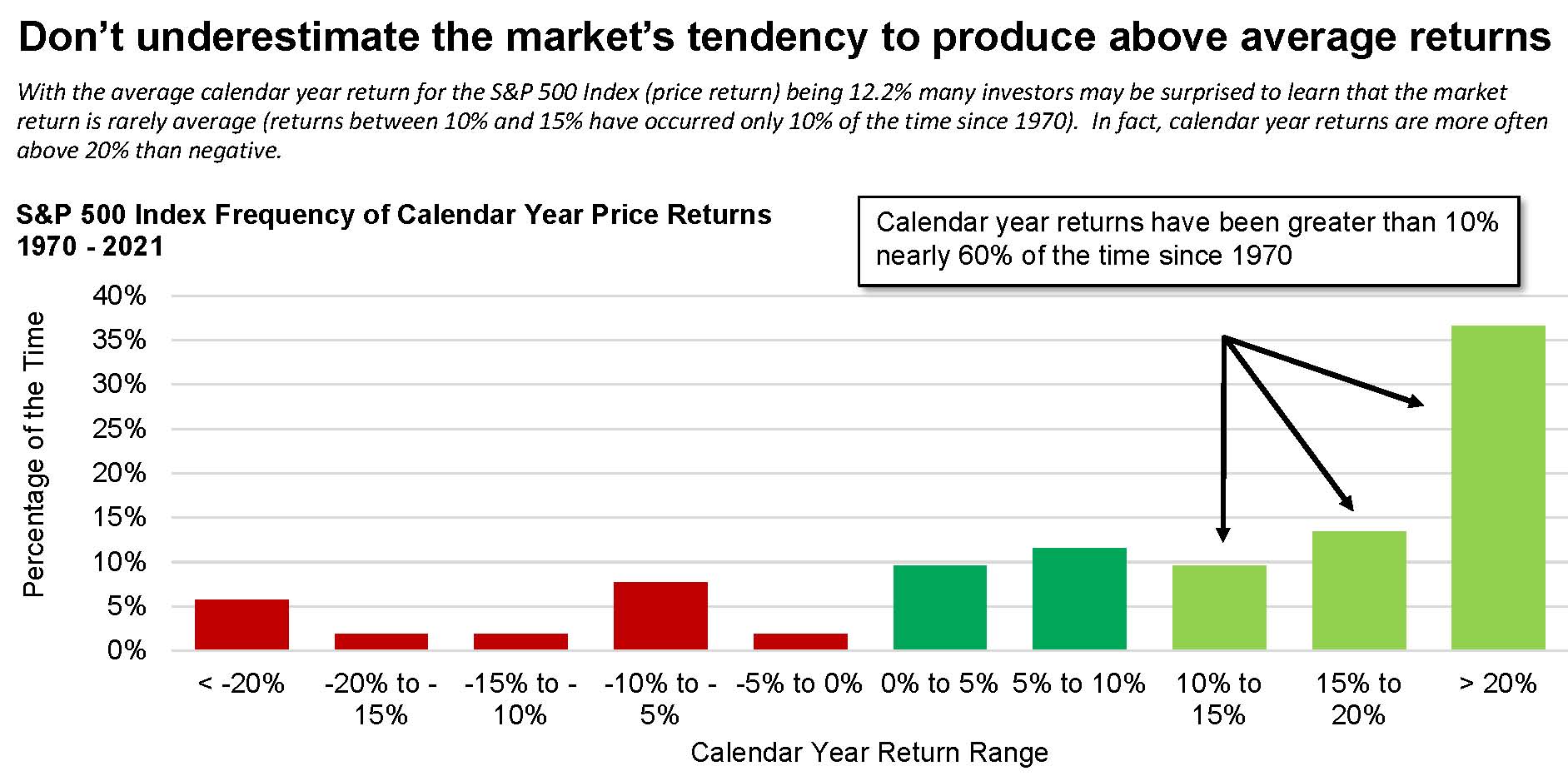

10%+ returns happen 60% of the time. When investment prices have already fallen, the chance of a positive return going forward are even greater.

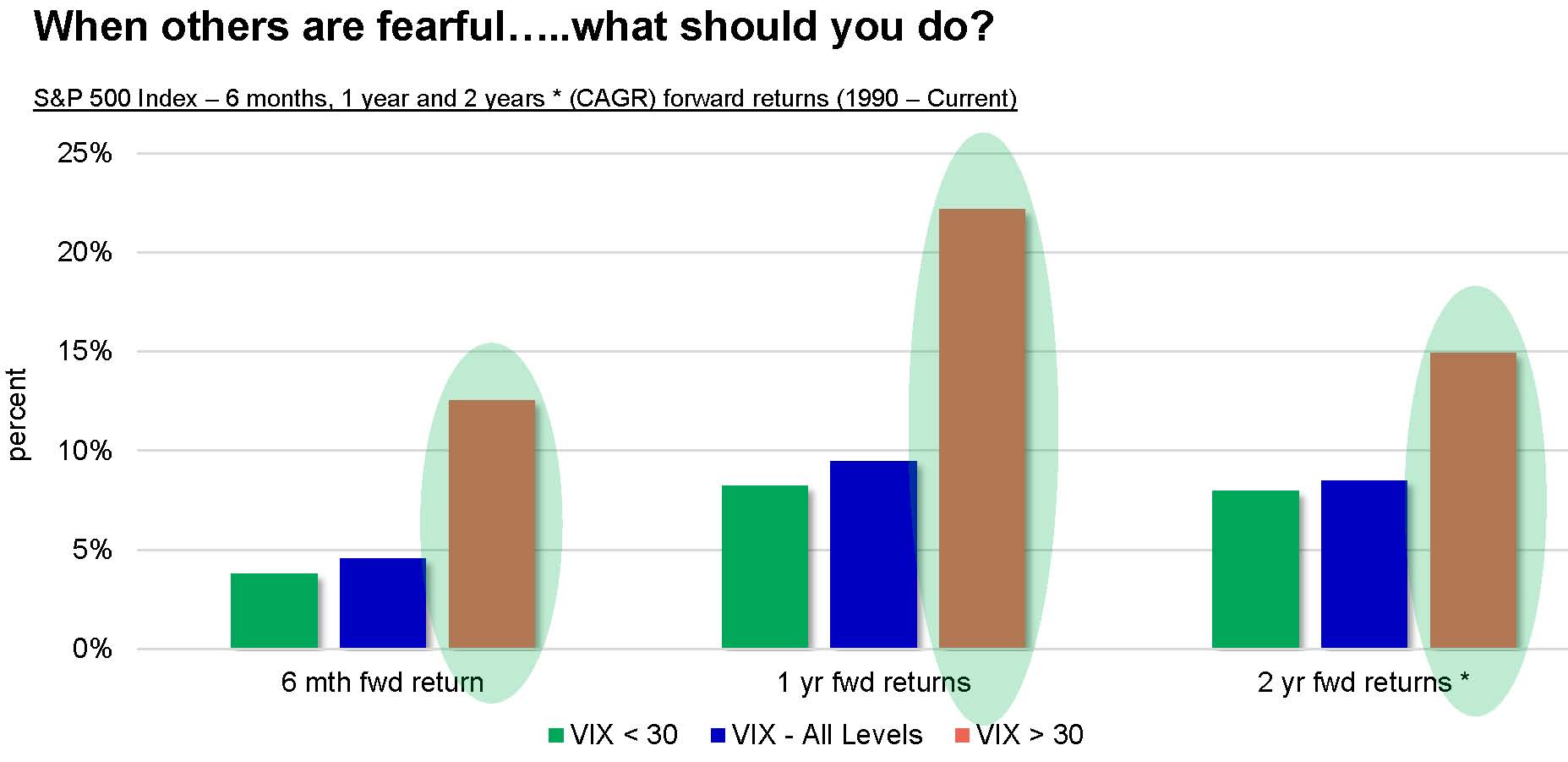

Volatility (VIX) is the “fear index”. When fear is at extreme levels (like today, or in the Fall of 2008 due to the global financial crisis, or in Spring of 2020 from Covid) the expected returns for the next 6 months, 1 and 2 years are much higher than normal.

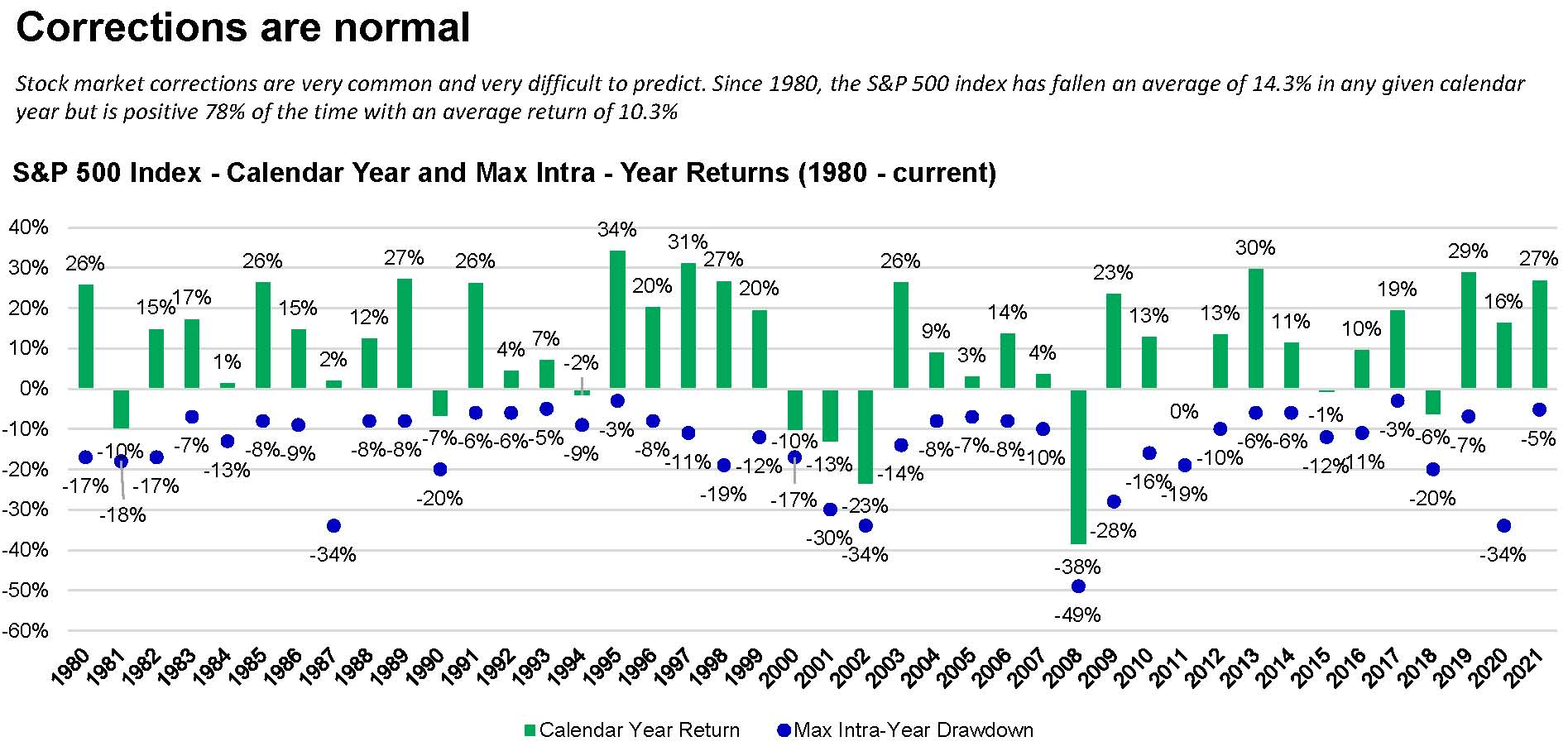

Corrections like we have seen (-20%’ish) are normal. They have happened as long as equity markets have existed. The smart thing to do is invest cash when prices are low. While waiting might feel like the right thing to do, it isn’t if you look at all the data. Think your way to investing don’t feel your way (only Olivia Newton John in Grease tells you that).

Along with those graphical evidences…

People’s balance sheets have actually improved since Covid hit because of government subsidies, rent relief etc. Consumers are in better shape than they have been in many years.

There is a backlog of manufacturing orders which means manufacturing won’t slow down anytime soon.

We were hit, out of the blue, by Covid and exorbitant amounts of money were pumped into the economic system. The current environment is a snapping back of the rubber band that, frankly, went a bit too far.

Should you be worried? It depends on what you are invested in. Do you own companies that operate and generate revenues globally, who are leaders in their field, and thus can increase their prices and people will still pay? These are the best places to have your money invested at any time, particularly when inflation is evident. However, that isn’t good enough. You have to be able to buy these for prices that don’t take into account their inevitable future growth. In other words, you should be able to own these companies today and not pay for their future.

I’m not worried. If you can be shown (and know) that you own these kinds of businesses, you shouldn’t be either, particularly now that the prices for these kinds of companies are cheaper again.

PS. Example of a company that is highly profitable, gaining market share and a big name in it’s industry / sector. It is paying a dividend of $0.50 / share per year and its share price is $10. That makes the dividend yield $5%/year. Its share price has now fallen to $7; that’s a 30% decline. It still pays the same dividend; 50 cents which works out to over 7% per year Do you keep sitting on your cash because it MIGHT (or could) fall further or do you buy now? One other importan fact I didn’t tell you. It only pays out 1/2 its net revenues to pay that dividend. In other words, it would have to lose 1/2 it’s customers and it could still pay that dividend from its earnings. A well managed portfolio has 30 – 100 of these kinds of companies. If you are still not sure about investing more cash to that same portfolio, I’d suggest your apprehension is predominantly driven by emotion rather than reason.